What Constitutes Early-Stage Venture Capital in the Investment Landscape?

Defining early-stage capital or an early-stage company is relatively straightforward.

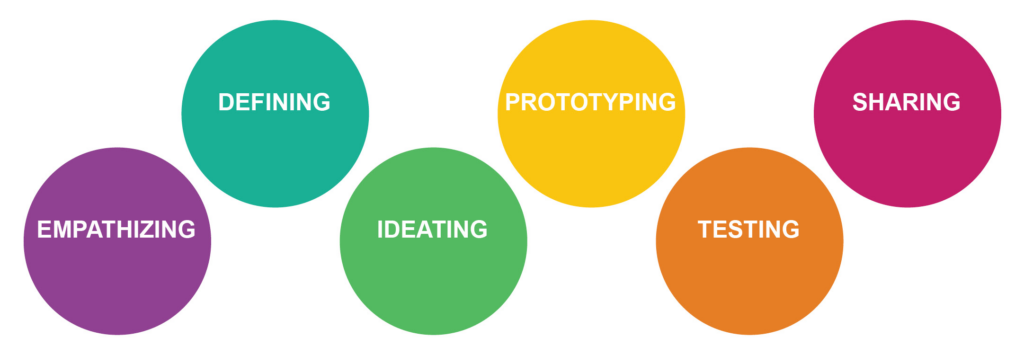

Early-stage companies are typically in the process of refining their services model, experimenting with prototypes, and formulating and sharing their business plan.

Early-stage capital might be invested in some startups, but eventually, in the long run, these investments may not yield the expected returns.

An early-stage company, in other words, is a new business with a recently developed business model designed to address at least one market pain point.

The above statement indicates that the company’s life is not yet mature but is in its initial phase, often referred to as “the startup phase.”

Venture Capital or VC is a form of private equity and a type of financing provided by investors to small startup businesses and companies that are believed to have long-term growth potential.

Typically, Venture Capitalists seek a good return on their investments, which can come in the form of an IPO or the acquisition of the company by a larger firm.

Jump To...

What distinguishes an Early-Stage company from a Late-Stage company?

Companies in the early stage and those in the late stage are not equal, of course! Early-stage companies typically focus on customer acquisition, and early-stage revenue generation. They are also interested in securing additional funds from institutional investors.

These steps enable early-stage investing for further business development and customer acquisition. It can be considered a step-by-step procedure as companies transition from having a few customers to maintaining a reliable customer base. In early-stage investments, many businesses can have the necessary tools but may require fine-tuning operations as they grow and learn.

Venture Capital in the Hosting Industry:

VCs are interested in investing in hosting companies, as this field usually holds a vast customer base and supports a very high-growth, well-margin business.

Hosting companies also require relatively fewer capital investments compared to other businesses.

Conversely, VC can be a prominent mode for hosting companies to obtain the capital they need for growth. It also delivers professional advice and guidance, which can be valuable to young businesses.

It also refers to the investment of money into hosting companies, and this capital can be utilized for funding new companies and further infrastructure needed to assemble hosting services.

How does the Venture Capital model operate in hosting companies?

VC firms typically invest in hosting companies expecting a good return on their investment. They seek hosting companies with a good history of success and are well-positioned for future growth.

Companies with solid leadership and well-managed staff are also under the radar of VCs.

In the equity exchange, Venture Capital investments are made. It signifies that the investor will get a portion of the company’s shares in exchange for their money.

Phases of Venture Capital:

All investors, including VCs and others, make it possible for entrepreneurs with little or no operating history to secure funds for launching their businesses.

Taking the risk of investing in unproven and unknown startups, investors accept equity stakes, believing that they will get significant returns if the companies become successful.

When opting for VC funding, seeking advice from seasoned entrepreneurs is essential to enhance your chances of success.

These firms typically anticipate securing a seat on the board and influencing decision-making processes.

Venture Capital comprises five stages, with two additional stages occurring before and after VC funding rounds.

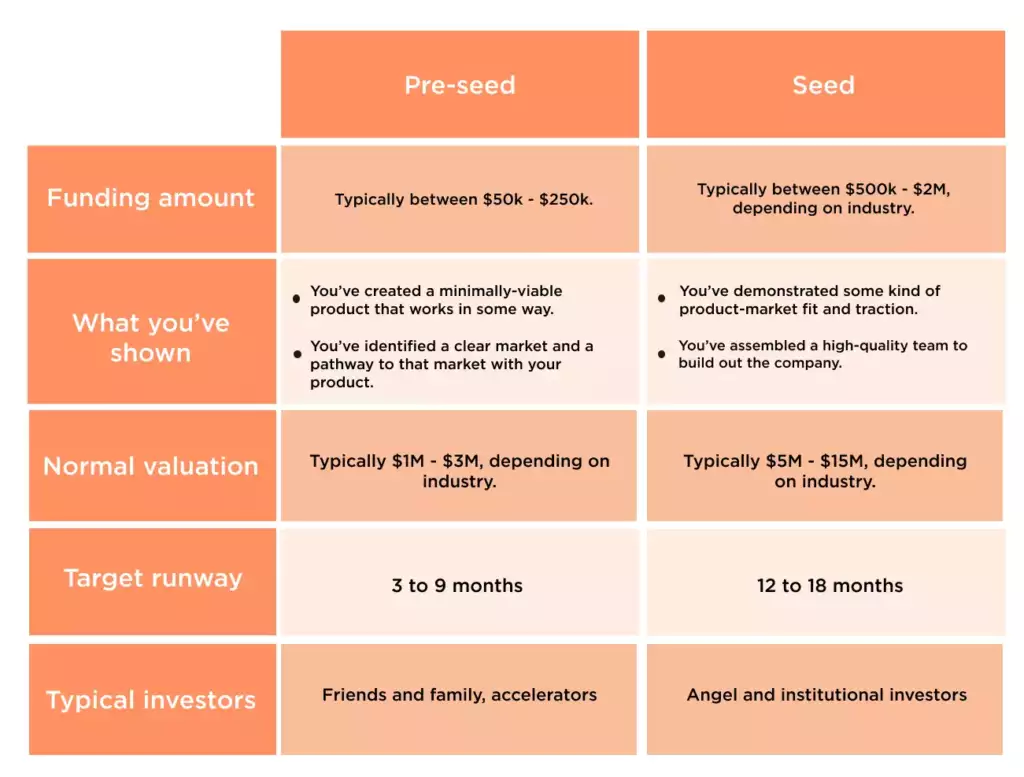

1. The Pre-Seed Phase

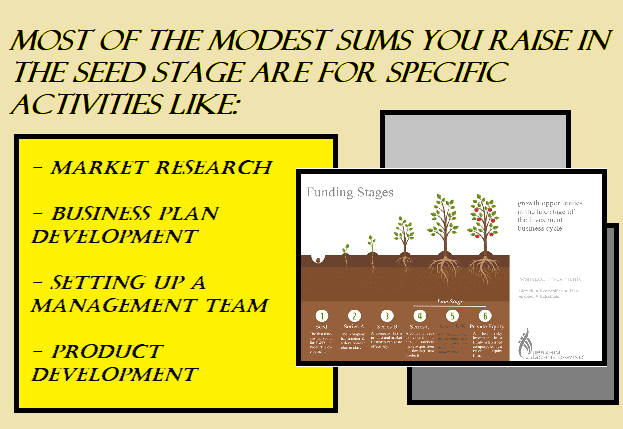

VCs require funding before getting ready to invest in ventures or get them in their early stages. It is time to initiate a product, new service model, or prototype for testing.

It is doubtful nowadays that VCs will contribute or propose money in exchange. You can initiate by developing a profitable business strategy and developmental growth plans for your business.

Many entrepreneurs look at other entrepreneurs throughout the early stage of business based on their experiences to support them.

Throughout the pre-seed stage, you can start winning a business plan and model for creating an achievable company using this advice.

In the long run, if the issues with your company become unconquerable, no investor will provide funds to a startup facing open legal questions.

Common investors at this stage are:

- Micro VCs or Early stage funds

- Family and friends

- Startup founders

The main aim is to provide and secure ample funding to prove to future investors that you have gained the capacity to scale and grow.

An investor from the VC firm will typically demand a seat on the board to look for operations and ensure that activities are moving on accordingly. The seed stage will often pitch additional investment rounds to help you grow.

VCs are taking much risk at this early stage, which could be expensive. To secure the investment, they may demand equity to secure the investment.

The most common investors at this stage are:

- Startup owner;

- Friends and family

- Angel investors

- Early venture capital

3. The Series A Phase:

The “Series A” stage is the first round of venture capital financing. Your company, at this stage, has an executable business plan and a pitch deck demonstrating product-market fit.

Now you need to:

- Fine-tune your product or service.

- Boost your workforce.

- Execute additional research required to endow your launch.

- Expand the funds required to accomplish your plan and attract further investors.

In the “Series A” stage, you must develop a solid plan to generate long-term profits.

Angel investors and traditional venture capital firms are the primary sources of Series A funding. However, corporate VC funds and family offices in the relative sector are available sources for funding.

These particular investors are more interested in startups with strong leaders and business strategies to lessen the risk of failed investments.

At this stage, ordinary investors include:

- Accelerators.

- Super angel investors.

- Venture capitalists.

- Corporate venture capital funds.

- Family offices.

4. The Series B Phase:

At this stage, your company is prepared to scale, and venture capital supports early growth funding for product manufacturing, sales, and marketing operations.

You will need a more significant capital investment for your company’s next growth stage. Funding for Series B is quite different from Series A. Investors gain confidence when they see good performance.

Family offices, VCs, and corporate VCs provide funding specializing in Series B to sponsor well-established startups.

They provide funds needed to start up, to form operational teams like customer service, sales, and marketing, and to grow markets.

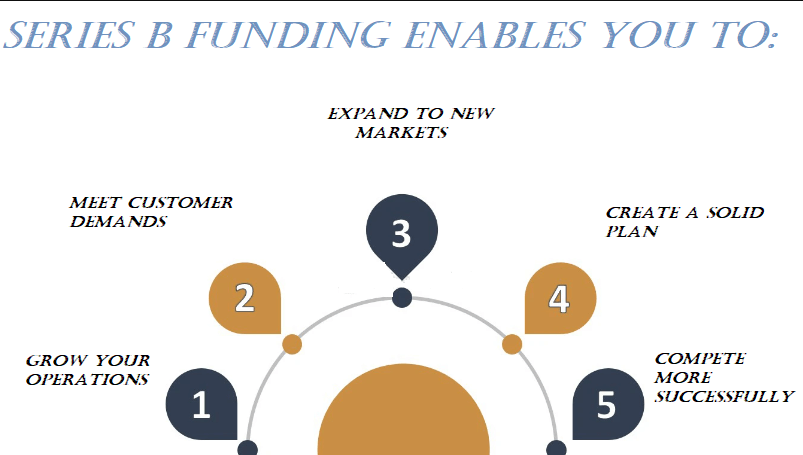

Funding in Series B allows you to:

- Grow your operations.

- Meet customer demands.

- Expand to new markets.

- Create a solid plan.

- Compete more successfully.

The significant investors at this stage are:

- Venture capitalists

- Corporate venture capital funds

- Family offices

- Late-stage VCs

5. The Expansion Phase or Series C

When you reach the funding stage of Series C, you are well on the way to growth. Success and incremental funding at later stages will support you in reaching new markets, building new products, and acquiring other startups.

You typically need 2 to 3 years to reach this stage as your company grows, and you are delivering consistent profitability and exponential growth.

It would be best if you were well-established with a solid consumer base to receive Series C and successive funding.

You also need:

- Steady revenue stream

- Account of growth

- Lust to expand globally

Investors are keener to invest in a company at the Series C stage as proven success means that they have less risk. At this stage, private equity, investment banks, hedge funds, and other traditional VC firms are more enthusiastic about investing.

Familiar investors at this stage are:

- Late-stage VCs

- Private equity firms

- Hedge funds

- Banks

- Corporate venture capital funds

- Family offices

6. The Mezzanine Phase

The final stage of venture capital holds the transition to a liquidity event, either M&A or an exit by going public. This is the stage of maturity and now requires funding to support at a larger scale.

The bridge or pre-public stage are new phrases that beautifully describe the mezzanine stage. It signifies that your business is an entirely fledged and viable business.

Any investors who have helped you reach this stage of success may choose to sell their shares and earn a meaningful return on their investment.

Leaving the original investors who helped you from the very first day of your journey opens the doors for late-stage investors to get in with a hope of an IPO or boosted sale.

Comprehending the Challenges Faced by Early-Stage Enterprises:

Securing funding or gaining attention from venture capitalists poses significant challenges, given the substantial number of early-stage VC firms and new startups entering the market annually. Not every early-stage VC firm or startup achieves success, and failures are not uncommon. However, early-stage companies proactively devise action plans to learn from past mistakes. For example, NEA (New Enterprise Associates) is an early-stage VC firm dedicated to making a positive impact on the world through investments in startups, particularly in the technology and healthcare sectors.

Here are some prevalent challenges faced by early-stage companies:

1. Transitioning from concept to reality

2. Ensuring adequate funding

3. Meeting expectations

4. Acquiring customers

5. Establishing trust

6. Navigating competition

Prominent Early-Stage Venture Capital Firms:

Premier early-stage VCs hold a significant role in the global startup ecosystem. Some of the prominent early-stage VCs include:

1. New Enterprise Associates

NEA, or New Enterprise Associates, is an early-stage VC founded in 1977 and currently based in Menlo Park, California. The company’s primary focus is on investments in businesses related to the technology and healthcare industries.

2. Amadeus Capital Partners

Founded in 1997, Amadeus Capital Partners is an English early-stage VC firm based in Cambridge, England. The firm’s key focus is on the technology industry, encompassing areas such as medical technology, enterprise software, cleantech, business services, and more.

3. Venrock

Venrock is an American early-stage Venture Capital firm based in Palo Alto, California. Founded in 1969, Venrock has a rich history of supporting innovative companies in advancing their services and products. The firm brings a wealth of experience, having worked with notable companies such as Intel and Apple.

Investing in Early-Stage Ventures - Pros and Cons:

Investing in early-stage startups carries both risks and rewards, and it differs significantly from traditional investments. Before engaging in early-stage seed funding, investors need to carefully evaluate all the potential advantages and disadvantages associated with startup investments.

Benefits of Investing in Early-Stage Startups

Investors often face uncertainty when considering investments in startups due to the inherent risks, potential for errors, and the extended time it takes to realize returns on their investments. However, investing in early-stage startups can provide unique opportunities that may not be available in more traditional investment options, offering the potential for substantial rewards despite the associated challenges.

Drawbacks of Investing in Early-Stage Startups

While the risks associated with early-stage startup funding are not always immediately apparent, understanding potential challenges and uncertainties based on available statistics can empower investors to make informed decisions before entering into any investment commitments.

Frequently Asked Questions

Early-stage venture capital refers to the financial support extended to startups or companies in their initial phases of development, usually before they achieve substantial revenue or profits. This type of funding is commonly provided by venture capital firms or angel investors who seek to invest in innovative and high-potential ventures.

The hosting industry encompasses businesses that offer web hosting services, enabling individuals and organizations to store their websites and other online content on servers accessible via the internet. Hosting companies provide various hosting options, such as shared hosting, dedicated hosting, cloud hosting, and more.

Early-stage venture capital funding may be extended to hosting startups that are either developing innovative hosting technologies, platforms, or services, or companies seeking to expand their offerings and enter new markets within the hosting industry.

Venture capitalists assess hosting startups on a range of criteria, including their business model, potential market size, the strength of their technology or intellectual property, the competence of their management team, and their capability to generate revenue and attain profitability.

Obtaining early-stage venture capital can furnish hosting startups with the financial means necessary for developing and introducing new products or services, expanding their operations, hiring additional staff, and more. Collaborating with venture capitalists can also offer startups valuable industry insights, strategic guidance, and connections to potential customers or partners.

Although obtaining early-stage venture capital offers numerous benefits, there are potential downsides as well. Venture capitalists usually anticipate a high return on their investment, which may put pressure on startups to achieve rapid growth and profitability. Furthermore, collaboration with venture capitalists may entail relinquishing some level of control over the company and its decision-making processes.